WTW has created an open source computer code that it claims can help investors gain up to 1.5% in premiums by using longer-term investment strategies. The code was developed by WTW’s non-profit research network, Thinking Ahead Institute (TAI). It is based on TAI research on the separation of short-term and long-term return components of an investment strategy, as described in TAI’s Fundamental Return Attribution (FRA) framework. The code is intended to make it simple for investment firms to apply the framework to their own portfolios and develop more meaningful reporting tools, which TAI claims would “transform” the industry if widely adopted.

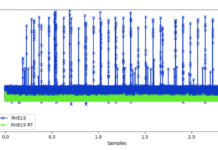

The code is intended to separate a portfolio’s returns into three components: changes in market sentiment, growth in portfolio fundamentals, and changes in holdings. According to TAI, this allows investment decisions to be evaluated based on changes in the fundamental characteristics of a portfolio over time, rather than just market-value returns. This promotes a longer-term perspective and allows for better communication between asset owners and asset managers about the long-term return drivers of an investment strategy, especially during periods of underperformance.

Furthermore, it should shift portfolio-review discussions away from a sole focus on short-term performance and toward the quality of underlying decision-making and the generation of long-term returns. Tim Hodgson, co-head of TAI, stated that the network’s research has identified a significant long-term investment premium of up to 1.5% per year that can be harvested and distributed to end beneficiaries. He went on to say that the industry had grown accustomed to short-term performance measures that are perpetuated by traditional reporting methods, resulting in mandates being terminated for “the wrong reasons and at the wrong time.”

“Hopefully, this is about to change as institutional investors are equipped with new tools to help them think differently while shifting their focus towards asset managers’ decision-making abilities and the fundamental drivers of returns,” he said.

TAI’s membership of 55 institutional investors from around the world, including Baillie Gifford, MFS, and S&P Dow Jones Indices, has all contributed to the development and testing of the framework and methodology. Through the code, the FRA framework can be applied to all asset classes, and WTW has already used it to evaluate equity managers beyond traditional frameworks. Craig Baker, WTW’s global CIO, also stated that the code could significantly improve investors’ efforts to meet their ESG objectives.

“We think this methodology will be able to support investors who seek to align their portfolios to ESG objectives but are struggling to identify if a portfolio’s decarbonisation is, for instance, due to underlying companies reducing emissions or the divestment of high-emission companies,” said Baker.

“We believe this framework, and an enhanced version of the tool, could provide much needed clarity into how ESG objectives are being managed and achieved.”