Despite its meteoric rise with the advent of cryptocurrencies, blockchain technology faces a conundrum — its limited adoption across diverse sectors. We delve into this ‘big problem’ for blockchain, exploring why a technology hailed as revolutionary primarily remains confined to the crypto realm. Challenges, misconceptions, and the potential future of blockchain in a world still grappling with its broader applications are also discussed.

Blockchain technology, at its core, is a digital ledger of transactions that is duplicated and distributed across an entire network of computer systems. Every time a new block is added to the blockchain, every computer on the network updates its blockchain to reflect the change. Through this mechanism, blockchain ensures that every transaction is transparent to all users and also remains immutable once added. In essence, it provides a trustworthy record without the need for intermediaries.

The real breakthrough for blockchain technology came with the rise of Bitcoin, the world’s first cryptocurrency. Proposed by an unknown entity named Satoshi Nakamoto in 2008, Bitcoin offered a decentralised way to conduct transactions without relying on a central bank or single administrator. This independence from traditional banking and governmental systems was its most alluring charm.

The crypto boom — blockchain’s claim to fame

There’s no discussing blockchain’s journey without mentioning the astronomical rise of cryptocurrencies. As Bitcoin grew in prominence, so did the underlying technology that powered it — blockchain. It didn’t take long for venture capitalists and other market savants to realise the potential for making easy money with cryptocurrencies and NFTs.

By 2021, what began as a fringe experiment with Bitcoin had evolved into a global phenomenon with thousands of digital currencies vying for attention. This crypto boom did more than just turn heads; it signalled a seismic shift in how people perceived money, value, and decentralised systems.

Several factors contributed to the crypto explosion.

Distrust in traditional financial systems: Post the 2008 financial crisis, there was growing disillusionment with centralised banking systems and fiat currencies. Cryptocurrencies, being decentralised and transparent, became an attractive alternative for many.

Speculative investment: As stories of early Bitcoin investors becoming millionaires began to circulate, more people dove headfirst into crypto as an investment opportunity, hoping to reap massive returns.

Technological curiosity: For many tech enthusiasts, the underlying blockchain technology was as alluring as the potential profits. The idea of decentralised, transparent transactions without intermediaries was groundbreaking.

New financial solutions: Cryptocurrencies and blockchain introduced innovative solutions to age-old financial problems. Concepts like smart contracts, decentralised finance (DeFi), and non-fungible tokens (NFTs) promised to reshape sectors ranging from lending and borrowing to art and entertainment.

The downfall of crypto and its impact on blockchain

While the crypto boom played a pivotal role in bringing blockchain to the forefront, it also cast a shadow. The very success of cryptocurrencies inadvertently confined blockchain’s perception to the realm of digital money. This overshadowing has, to some extent, influenced the challenge blockchain faces in finding its footing in diverse industries outside the world of crypto.

To make matters worse, the cryptocurrency market experienced a major crash in 2021, with the total market capitalisation falling from nearly $3 trillion to less than $1 trillion. This crash was caused by several factors, including rising inflation, rising interest rates, and increased regulatory scrutiny.

One of the biggest scandals that contributed to the crash was the collapse of the cryptocurrency exchange FTX. FTX was a major player in the crypto market, and its collapse caused a wave of panic selling. The scandal surrounding FTX involved allegations that the company was insolvent and that it had engaged in market manipulation.

This triggered the Securities and Exchange Commission (SEC) to act and the crypto crackdown began. The SEC issued several enforcement actions against crypto companies, alleging that they had violated securities laws. These enforcement actions further shook the confidence of investors in the crypto market.

The crypto crash of 2021 had quite a few remarkable consequences. First, it caused a significant loss of wealth for investors. Second, it led to increased regulatory scrutiny of the crypto market. Third, it damaged the reputation of cryptocurrencies and made it more difficult for crypto companies to raise capital. It was a major setback for the cryptocurrency industry, but moreover, it was a major setback for blockchain technologies.

As funding for crypto projects seized, blockchain projects focused on other domains also felt the impact.

According to a report by CB Insights, venture capital funding for blockchain companies fell by 88% in the first half of 2022 compared to the same period in 2021. The report also found that the number of blockchain deals fell by 60% in the same period. The lack of clear use cases for blockchain technologies outside of the crypto industry made it difficult for investors to see the potential return on investment for these projects.

The theoretical use cases for blockchain outside of crypto and finance

Before we jump into the current state of blockchain, it is necessary to summarise some of the potential problems it could theoretically solve, outside of crypto and finance. These are the potential use cases that have been talked about for nearly a decade now.

Supply chain management: Blockchain can be used to track the movement of goods and materials through a supply chain. This can help to improve efficiency, transparency, and traceability.

Healthcare: Blockchain can be used to store and share medical records in a secure and private way. This can help to improve patient care, and to reduce fraud and errors.

Government: Blockchain can be used to create secure and transparent records of government transactions. This can help to improve accountability and transparency, and to reduce corruption.

Other industries: Blockchain is also being explored for use in other industries, such as insurance, real estate, and media.

The current state of blockchain technology outside of crypto and finance

Outside of cryptocurrencies, most of which are directly or indirectly under the investigation of SEC, not much has happened for blockchain technology. The total locked value (TVL) of decentralised financing went from an all-time high of $248 billion in 2022 to less that $40 billion in 2023, and NFTs cooled off almost as fast as they had heated.

I did a survey of large scale applications of blockchain technologies in 2023 and I am afraid I could not find much to talk about. Keep in mind that this is my own personal research and therefore it’s not conclusive. I might have missed an application or two, but overall, large scale applications (not related to crypto and finance) currently running on blockchain technology are next to non-existent.

Current applications of blockchain across the world

IBM Food Trust: IBM Food Trust is a blockchain-based platform that tracks the movement of food products through the supply chain. Launched in 2021, this platform is used by food producers, retailers, and distributors to ensure the safety and authenticity of food products.

Walmart: Walmart is experimentally using blockchain technology to track the movement of produce through its supply chain at a limited capacity. Not much has been spoken about this project since its inception in 2022.

Estonia: Estonia is using blockchain technology to record land ownership and manage elections. It is one of the most advanced countries in the world in terms of its use of blockchain technology.

United Arab Emirates: The United Arab Emirates is using blockchain technology experimentally to track the movement of goods and materials through its ports.

The ‘big problem’ for blockchain

For most blockchain experts, the big problem to solve is the ‘blockchain triad’, as coined by Vitalik Buterin, wherein every blockchain application has to choose between focusing on decentralisation, security or scalability but cannot have all three without compromising on at least one.

But I would like to argue for a bigger ‘big problem’ for blockchain — adaptability. Outside of Bitcoin, which seems to be the only technology to find its grounding in a proper use case and an application, blockchain is struggling. We are yet to put theory into practice when it comes to blockchain and this is becoming clearly evident with every passing day.

Probable reasons for the blockchain adoption abyss

As a researcher, I can only share potential reasons for the lack of adoption of blockchain technology based on observational data. This is by no means an exhaustive list of reasons, and I welcome any feedback and criticism on the points that I have raised here.

Complexity and understanding: Not only does blockchain suffer from bad PR due to crypto and NFTs, it also has a problem with outreach. Most people, including the ones invested in blockchain technology, do not understand how the technology works and what makes it uniquely useful. A survey by Statista in 2022 found that only 39% of Americans have heard of blockchain. Of those who have heard of it, only 16% said they have a good understanding of it.

Lack of investment by big tech: Although tech startups disrupt industries more often than big tech, it is often the big tech companies that throw money behind such companies and projects to fuel the disruption. A classic example is Microsoft with OpenAI. Unfortunately, such a thing has not happened in the case of blockchain. Despite there being no shortage in blockchain startups, big tech companies such as Google, Microsoft and Meta have not been very forthcoming in investing in these projects. In fact, the world of big tech has been suspiciously silent on the whole blockchain saga. There are multiple reasons for this.

- The crypto contagion: The most valuable asset of a big tech company is its stock price. Protecting the value of its stock is the first priority for the CEOs of such companies. Therefore, getting into a technology that has direct ties with the crypto space can be potentially damaging for the stock price.

- Lack of regulatory clarity: Even if an interesting project worth investing were to come up, it is difficult for cryptocurrencies to not play some form of a role in that project. Given the lack of regulatory clarity from the SEC, as it stands today, the future of blockchain projects can be highly speculative. Big tech likes due diligence when it comes to regulatory issues for obvious reasons.

- Blockchain is not a one-fit-all model: Unlike a technology like AI, blockchain is not a one-fit-all model. It caters to a specific set of use cases that mostly revolve around security. So, while the technology might be attractive, it doesn’t mean that every tech company has a potential need for it.

- Problems with integration: To integrate blockchain into a pre-existing system, a ground up rebuild of the entire system is required. Imagine having a house without any plumbing. Now, to lay pipes, you will have to break all the floors and every wall in the house. It is easier to just break the house and rebuild it from scratch. But what if it wasn’t a house but a 1000 acre palace with 100s of rooms? That’s basically the conundrum for big tech companies. Even if they found an application for blockchain in their preexisting products, they are just too big to be rebuilt from the ground up.

Regulatory concerns and VC funding: As already discussed, there is a lack of clarity as to where SEC stands on most crypto projects. Crypto projects are inherently linked to blockchain projects outside of crypto. Every technology requires VC trust in order to thrive as they are the ones who put their money on the line to fund speculative projects. With blockchain, there can be no trust unless there is regulatory clarity. Therefore, the money is running dry, demotivating any further innovation in this space.

The blockchain triad: As stated earlier in the article, the blockchain triad is an existential problem with current blockchains. A technology as pristine as Bitcoin, too, is not immune to this problem. Bitcoin focuses on security which then raises issues with scalability on level 1. Developers bandage this problem by building layer 2 blockchains over the layer 1, but that adds up complexity and compromises on decentralisation and security. Research is still ongoing as to how this problem can be mitigated, but for now, the problem remains.

The looming quantum conundrum: As the world edges closer to realising the potential of quantum computing, the very foundation of blockchain technologies is under threat. Quantum computers, with their ability to perform complex calculations at unprecedented speeds, have the potential to crack cryptographic algorithms that keep blockchains secure. Traditional cryptographic methods, like the ones employed in many cryptocurrencies, rely on problems that are computationally hard for classical computers to solve, such as factoring large numbers. However, quantum algorithms, like Shor’s algorithm, can solve these problems efficiently. If large scale, practical quantum computers become a reality, they could decrypt blockchain records and forge transactions, effectively dismantling the trust and security that underpin blockchain systems. This quantum conundrum underscores the need for post-quantum cryptographic methods if blockchain technologies are to survive in a post-quantum world.

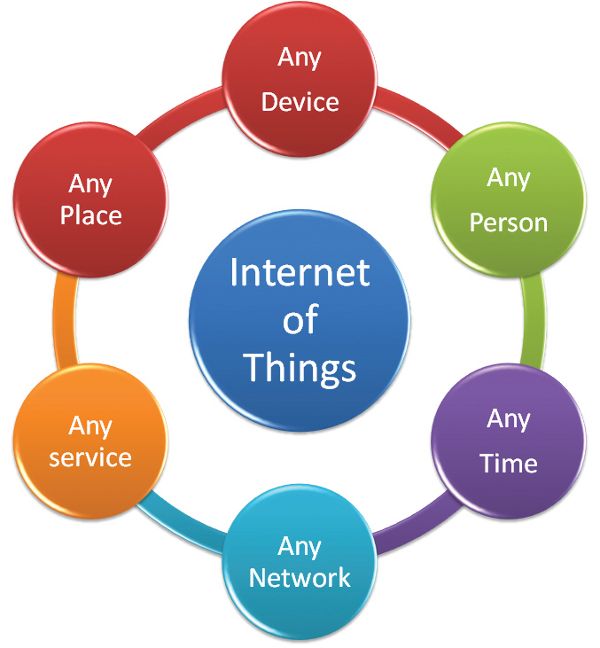

A potential ‘X-chain’ that supersedes blockchain altogether: While blockchain has been lauded for its potential to revolutionise sectors from finance to supply chain, it’s not impervious to being supplanted. Emerging advancements, such as artificial intelligence (AI), offer enhanced data analysis and decision-making capacities, which might render some blockchain applications redundant. Quantum computing, as discussed, poses a direct threat to blockchain’s cryptographic security. Furthermore, concepts like the ‘Blockchain Triad’ (which advocates a synthesis of blockchain, AI, and the Internet of Things), hint at a future where blockchain isn’t the standalone star but merely a part of a more intricate technological matrix. As history has shown, no technology is sacrosanct. If a more efficient, secure, and scalable solution emerges, it could relegate blockchain to the annals of technological history, much like its predecessors.

Some of the reasons why blockchain is struggling can be addressed rather quickly. For instance, if the SEC moves fast and makes the regulations for blockchain technologies clearer, it can instantly boost the VC trust leading to reflow of funding in the space. This could have a chain effect with big tech trusting the technology and taking steps for adopting blockchain, which could then help startups build disruptive technologies using blockchain. However, there are also some existential threats to blockchain, the solutions for which are currently unclear. Issues such as quantum conundrum and Blockchain Triad are problems that could lead to people developing a newer more advanced technology that renders the concept of blockchain moot.

Personally, I feel blockchain is a great technology with a lot of potential to offer. The rise of Bitcoin is a testament to that. But for blockchain to thrive as a technology at large, the ‘big problem’ needs to be addressed by the tech community.