On April 11, Perforce Software announced the acquisition of Puppet, a DevOps pioneer. The deal’s financial parameters aren’t being made public. Puppet was founded in 2009 and has raised $189.5 million in investment to expand its DevOps infrastructure automation capabilities over the last decade. The startup was a pioneer in the DevOps arena, helping to pioneer some of the field’s core concepts, such as configuration as code and process automation. Ansible, which Red Hat bought for $150 million in 2015, and Chef, which Progress Software bought for $220 million in 2020, are often compared to Puppet and its technology.

Perforce purchased Rogue Wave in 2019, the company behind a number of technologies, including Zend Software, a PHP supporter, and OpenLogic, an open source services provider. Broadcom sold Perforce the Blazemeter continuous testing technology in 2021. Puppet will be run as a business unit within Perforce, supplying Puppet-branded infrastructure automation technology alongside other DevOps business units, according to Ties.

“Puppet pioneered what is now known as infrastructure as code and spearheaded effective practices for DevOps that flourish today,” he said.

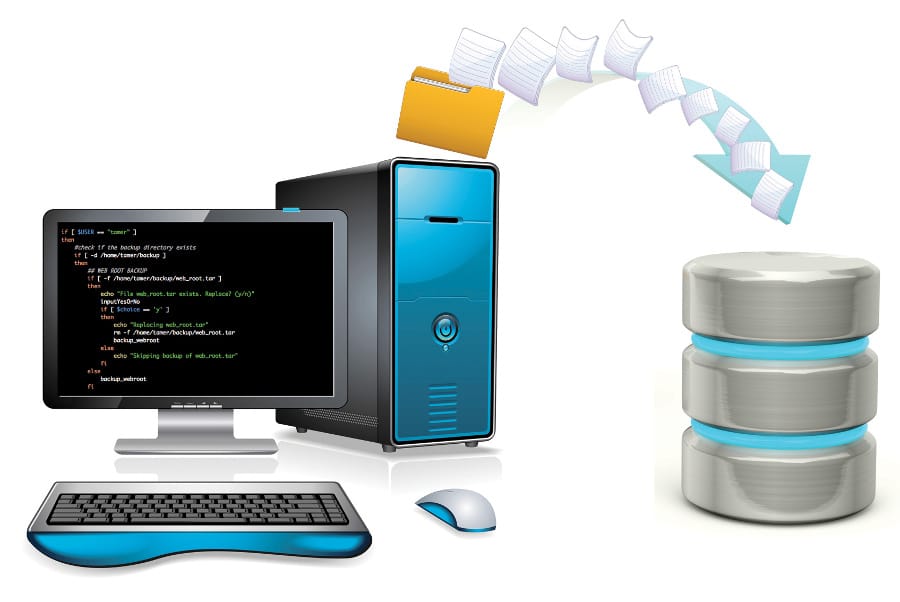

Ties explained that Puppet currently automates several aspects of the infrastructure management lifecycle, including provisioning, patching, configuration, and maintenance of operating system and application components in data centre and cloud infrastructures. In the future, he expects Puppet will continue to innovate and provide services to aid DevOps teams as part of Perforce. Perforce, he believes, will be a strong steward for Puppet in the open source community.

“Perforce also has a history in the open source community with OpenLogic and Zend product lines,” Ties said. “The company looks forward to expanding its open source presence through active engagement with the Puppet community with this acquisition.”