According to Bybit, adding cash to Curve Finance has been made simpler. The first institutional staking marketplace was recently established by ConsenSys.

The Shanghai Upgrade to the Ethereum decentralised blockchain is anticipated to present future opportunities for Bybit, a cryptocurrency exchange with headquarters in Dubai. To provide users with access to its “uncomplicated ETH staking options,” the exchange on Friday debuted its brand-new, “optimized” Web3 Staking Pool.

The Shanghai Upgrade is a hard fork on the Ethereum network that will allow holders of ETH to un-stake their assets for the first time. It is the first significant development since the Ethereum Merge, which was carried out in September of last year. The upgrade was initially planned to take place this month, but is now predicted to take place next month.

According to a statement from ByBit, its staking pool “dramatically simplifies” the procedure for providing liquidity to Curve Finance, an automated market maker and decentralised exchange. According to ByBit, its pool reduces the stages from 11 to just 3, saving users money on transaction fees.

“The added benefits could lead to an ETH staking Annual Percentage Rate (APR) of up to 6.5%. And Bybit users don’t even need to buy ETH as the product can be accessed using BTC, USDT and USDC balances,” the United Arab Emirates-headquartered digital asset firm states.

Ben Zhou, the Co-Founder and CEO of Bybit, commented on the development and said that the cryptocurrency exchange plans to introduce “highly liquid and trading-integrated ETH staking options” during the anticipated Shanghai Upgrade time. The users of the exchange will now have “many new opportunities” available to them.

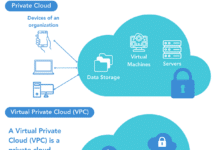

Meanwhile, the first market for institutional cryptocurrency staking was recently introduced by ConsenSys, a software firm that specialises in decentralised protocols and Ethereum. This is because the business anticipates that the Shanghai Upgrade will increase institutional holding in ETH.

In collaboration with Allnodes, a non-custodian staking and blockchain node infrastructure provider; Blockdaemon, a blockchain infrastructure company; and Kiln, an enterprise-grade staking platform, ConsenSys launched the market under MetaMask Institutional, its multi-custodial institutional web3 wallet.